Life Is a Data Play: Why Advisors Must Rethink Health and Longevity Forecasting

There’s a quiet revolution happening inside the advisor-client conversation—and it’s being led not by markets but by medicine.

You’ve seen it. You feel it. You’re not just a portfolio guide. You’re a hope broker. A frontline translator between fear and clarity, especially as your clients begin asking the deeper, harder questions:

- “What happens if I live longer than we planned?”

- “What if I get sick… or my partner does?”

- “Will I have enough if healthcare costs keep climbing?”

These aren’t hypothetical concerns. They’re planning imperatives. And if your models aren’t keeping up with the personal—and profoundly financial—impacts of health volatility and longevity inflation, then the conversation is already behind.

The new HighPeak playbook offers an advisory blueprint for this very shift. Below, we break down some of the key insights.

The Hidden Risk Advisors Can’t Ignore

We’ve long accepted that markets are volatile. But we rarely apply the same thinking to Life itself—the unexpected caregiving detour, the late-stage medical cost spike, or the regional health inflation curve that quietly erodes a carefully designed drawdown strategy.

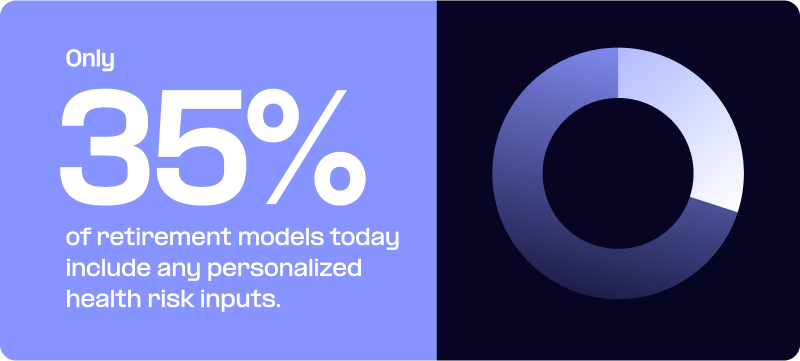

Only 35% of retirement models today include any personalized health risk inputs.

That means 65% of plans may be based on assumptions that ignore one of the largest, fastest-growing financial liabilities in retirement: healthcare costs.

The reason for this is simple. Many advisors still rely on national cost averages and static models that don’t flex with location, policy changes, or actual client health status.

Ask yourself:

- Are you still relying on backward-looking cost assumptions in your longevity projections?

- Do your plans dynamically incorporate Medicare Part B and D shifts?

- Can your current platform simulate late-life health volatility with regional accuracy?

If not, your clients may be facing uncertainty without the benefit of the full power of your insight. That may mean that despite your best intentions, you may not be able to provide your clients with the direction they need.

Building the New Data Foundation

Traditional modeling is no longer enough. Healthcare costs don’t move in straight lines. They spike, shift, and regionalize.

At HighPeak, we advocate for a four-dimensional approach to data-driven insights:

Significance:

What health variables most impact financial outcomes?

Interpretation:

How do location, behavior, and policy shape cost risk?

Function:

Where does this data directly influence portfolio design?

Timing:

When do proactive changes deliver the most benefit?

With insights and a framework for interpreting them, you can transform how you build strategy and translate new data into action.

Wondering where to get that data? Just like your streaming service or your predictive analytics suite, HighPeak’s solution delivers insights via API.

From Data to Design: Enter Microservices

Many advisors struggle to connect dynamic healthcare variables with investment platforms. That’s where HighPeak AI’s microservices come in– through API-powered microservices that can deliver insights directly to your predictive analytics platform of choice.

With HighPeak AI’s healthcare cost dashboard, advisors can simulate custom variable healthcare and long-term care cost scenarios instantly and adjust for everything from pharmaceutical inflation to regional CPI variance.

Imagine showing a client how a diagnosis at 76 or a 9.2 percent regional long-term care spike could impact their estate goals and then being able to model multiple strategy pivots using your predictive analytics suite of choice in just seconds.

That means you’ll have the right insights on demand, regardless of the predictive analytics suite you might currently use.

The Compliance Imperative: You Can’t DIY This

Let’s be clear: health data is not just another data feed. It’s subject to HIPAA, fiduciary standards, and growing state-level insurance oversight.

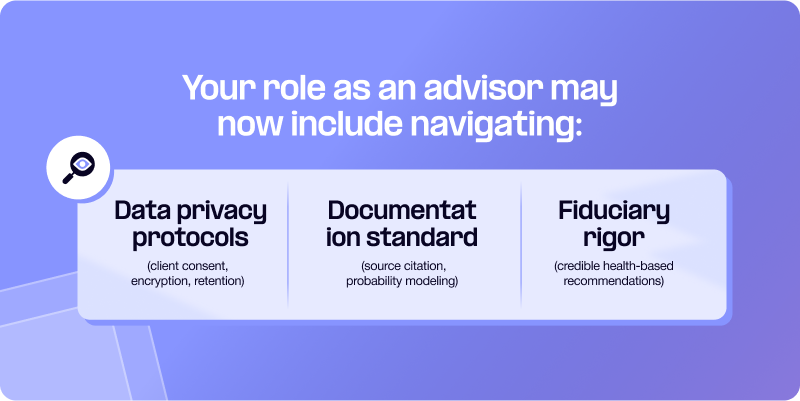

Your role as an advisor may now include navigating:

- Data privacy protocols (client consent, encryption, retention)

- Documentation standards (source citation, probability modeling)

- Fiduciary rigor (credible health-based recommendations)

Platforms like HighPeak handle this data management complexity behind the scenes, giving you compliant, clean insights you can use confidently in every conversation.

Ask yourself:

- Do I know where my data inputs come from and how often they’re updated?

- Can I show the rationale behind a long-term care cost assumption?

- Do my planning tools account for healthcare cost volatility?

- If the answer is no, the risk is not just your clients’ alone, it’s yours.

Is Your Data Ready for Change?

Consider a 55-year-old client couple, both working full-time and planning to retire at 68. Based on national averages, their long-term care projection looked manageable.

But when one spouse’s sibling entered assisted living suddenly, and family caregiving support evaporated, every previous assumption had to change. Their advisor used HighPeak’s scenario engine to model:

- Regional care cost inflation

- Loss of informal care

- Increased withdrawal pressure starting at 76

The result? A significant projected portfolio drawdown, one that may have gone unseen in traditional models.

With the right data, the advisor could help the couple reallocate coverage and shift the glide path strategy before the risk matured.

Consider the Source: Data Origins Matter

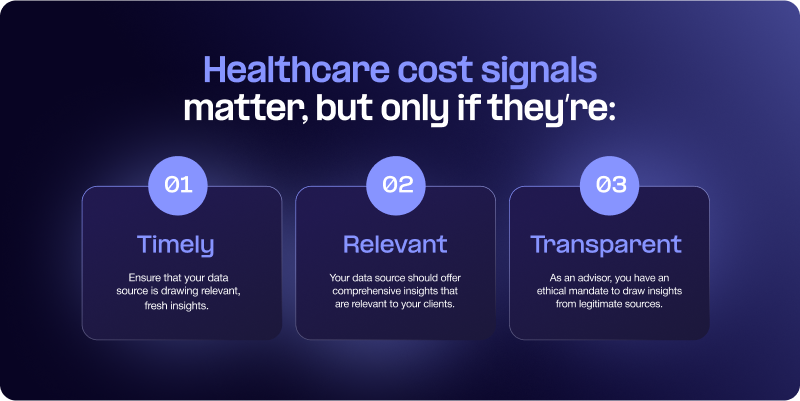

Healthcare cost signals matter, but only if they’re:

Timely:

Old data leads to scaling inaccuracies when you’re working at the speed of AI. Ensure that your data source is drawing relevant, fresh insights.

Relevant:

Context is everything, and your healthcare and longevity data source should offer comprehensive insights that encompass the regions and situations relevant to your clients.

Transparent:

As an advisor, you have an ethical mandate to draw insights from legitimate sources. With HighPeak AI, supported by Prudential, you can be assured that the data you access is collected and processed in compliance.

Ready to Reframe the Conversation?

Your data is your Swiss Army Knife equivalent. It can defend your clients’ interests and also whittle off unnecessary strategies as needed.

Download the full playbook:

“Precision Data, Health and Longevity Data, and The Future of Forecasting”

and learn how to future-proof your advisory strategy.