From Fear to Moving Forward: How to Talk About Aging with Clients

Reframing a Difficult Conversation

Behind every question about “how much is enough?” is a very human fear—longevity. We all want to live long, healthy lives, but health is a wildcard, as is inflation. Staying healthy and caring for ourselves and our loved ones is costly, and hence, we often frame longevity as a risk.

That risk is palpable: outliving one’s resources, becoming a burden, or being blindsided by health costs are all legitimate fears.

As a financial advisor, you deal in hope and data, not fear. Your work is meant to be the antidote to panic. As you broach the topic of aging with your clients, you’ll want to be ready to share insights that are comforting because they’re accurate and relevant, not just positive.

This is where tools like HighPeak’s predictive healthcare and longevity data solution can be transformative. With healthcare and longevity data from HighPeak, advisors can reframe sometimes uncomfortable discussions about aging as opportunities to recalibrate strategy to support a concerned client’s long-term goals.

Let’s explore how to move client conversations from emotional territory into a data-informed strategy.

The Emotional Undercurrent

Sometimes, clients hesitate to discuss aging because they’re overwhelmed.

It’s a lot to take in at once. And marketplace uncertainty only adds to the FUD—fear, uncertainty, and doubt—that can cause clients to resist thinking about longevity.

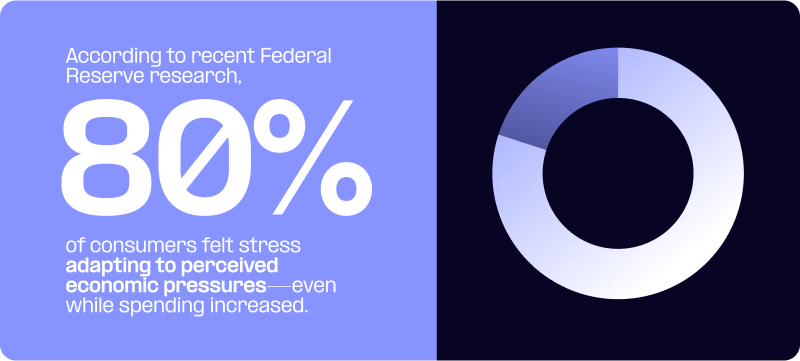

According to recent Federal Reserve research, 80 percent of consumers felt stress adapting to perceived economic pressures—even while spending increased. That cognitive dissonance may also apply doubly to healthcare costs. It’s human nature—people fear the unknown and overestimate the risk but don’t always act on it.

Clients empowered with data tend to make smart choices. Facts can cut through the noise and the fear and inspire positive action. With HighPeak’s probabilistic cost estimations, advisors show clients a range of possibilities and personalize healthcare cost predictions. That can mean deeper conversations and more transparency around recommended strategies.

Tackling Hidden Risk: Longevity and Health Costs

Traditional wealth models tend to underestimate two major variables: how long clients will live and how much their healthcare might cost them. Together, these form what we can refer to as “hidden volatility.”

Clients may plan for a 20-year retirement, only to face 30 years of medical costs, in addition to caregiving needs, housing transitions, or adult children unable to support them.

HighPeak AI’s platform enables advisors to ingest dynamic inputs—like regional medical CPI, policy shifts, and long-term care cost data—into real-time cost scenarios. This approach can move the conversation from “How long will you live before your funds run out?” to “How might your care needs evolve across each decade?”

The Conversation Starter: A Data Platform

HighPeak’s architecture rests on API-powered microservices. Rather than forcing advisors to migrate to new platforms, HighPeak integrates with existing predictive analytics tools to layer in advanced healthcare cost modeling capabilities.

That means advisors can create personalized healthcare cost forecasts, long-term care risk profiles, and longevity simulations without altering their tech stack. That said, healthcare data is powerful and sensitive. That’s why HighPeak is designed with compliance at its core.

The Regulatory Imperative—Planning with Precision and Prudence

Financial professionals operating in this space must navigate a web of obligations, from HIPAA data handling protocols to fiduciary disclosure standards. HighPeak supports this with built-in safeguards: consent management, data transmission encryption, and documentation protocols that align with industry regulations.

Turning Anxiety into Agility

Clients often come to advisors with vague concerns: “Will I be okay?” “What if I need care?” “How can I afford to help my kids and still protect my future?”

HighPeak’s data platform allows these open-ended fears to be turned into structured healthcare cost forecasts. Instead of reacting to a diagnosis, clients can proactively map their care trajectory from any age.

One standout capability of the HighPeak AI platform is scenario stacking—simulating what happens when multiple healthcare or longevity cost stressors occur at once, e.g., a downturn, a move, and a parent needing care.

With visual models and longevity overlays, HighPeak AI’s user-friendly dashboard makes moving the conversation from “what if” to strategy simple.

A New Conversation Template

With HighPeak AI data, advisors can:

- Tailor healthcare and longevity cost recommendations to each client’s health profile, region, and goals.

- Present a range of potential healthcare cost impacts on client portfolio

- Incorporate current data on healthcare inflation and longevity into a long-term strategy.

Leading with Empathy (and Data)

With the right tools, financial advisors can help clients reimagine the aging process in a positive light. HighPeak’s AI-powered microservices allow advisors to understand their client’s financial needs at the deepest level—longevity—to customize their healthcare cost planning.

HighPeak AI offers seamless, compliant API-based tools to enhance your existing planning platform. Whether you’re navigating retirement strategy, healthcare inflation, or evolving client needs, our precision data solutions help you turn uncertainty into action.

Learn more about HighPeak’s data solutions.