Access is Everything: Enhance Your Financial Data for Actionable Client Insights

Data is a tool and a resource that—when handled correctly—can transform how you and your clients develop long-term financial strategies. The right insights, unlocked at the right time, can help you get more from your existing data by adding previously unseen contexts. Those contexts- like healthcare costs and longevity—may be key to your client’s long-term financial goals. In this post, we’ll show you how to access and present that data.

The Real Challenge: Beyond Market Data

Traditional financial planning tools often treat the market as a closed loop. But your clients don’t live in isolation. They’re navigating inflation, longevity concerns, and potential changes in healthcare policies. Those concerns can impact everything from how your clients respond to your advice to the viability of their long-term retirement plans.

To be able to support your clients, you’ll need the right insights. The gap between conventional analytics and real-world impact is where many financial strategies fail. A simulation based purely on historical market data might miss a spike in long-term care costs affecting your client’s region or the delayed retirement trends reshaping withdrawal strategies across your client’s peer group.

Despite heavy technology investments, many advisory practices still operate with incomplete datasets. That means they may be making decisions relying on market-centric models while real-world factors drive actual client outcomes. The remedy? Access the right data.

Read on for our quick-start guide.

Step One: Build a Solid Analytics Foundation

First, you’ll need the basics. At HighPeak, we believe your data infrastructure should meet four critical standards:

Connectable:

Your analytics tools must integrate seamlessly with existing CRM platforms, risk management systems, and client communication channels. Data silos kill insight velocity.

Operational:

Data solutions should function like APIs—plug-ins to gain immediate value, not months-long implementation projects that drain resources before delivering results.

Resilient:

As your clients’ needs to evolve and markets shift, your data tools must scale and adapt without friction or fragmentation. No one has time to rebuild analytics infrastructure every time strategy changes.

Not sure how to get access to the right data? Learn about our API solutions.

Step Two: Determine What Really Matters

Not all data points are created equal. One of the most daunting challenges in today’s planning landscape is the sheer volume of inputs available.

An AI-powered data service like HighPeak can transform this dynamic by delivering critical healthcare and longevity insights. In practical terms, this means an advisor can bypass irrelevant variables and instead focus on core insights— like a spike in state-level long-term care costs or shifts in pharmaceutical subsidies affecting Medicare Part D.

The Real-World Layer

Significance is contextual and predictive. Healthcare inflation might spike 3 percent nationally, but if your client lives in a region where long-term care costs are much higher, this may change your strategic outlook.

HighPeak AI captures these nuanced, location-specific, and demographically relevant patterns that traditional models miss and provides the critical insights you’ll need to adjust strategies accordingly.

HighPeak AI can help you answer questions like:

- Would I prioritize this data if I had only minutes to adjust the plan?

- Does this information support, contradict, or reframe the client’s existing assumptions?

- How might this data evolve under future conditions—and will it still be significant?

Step Three: Contextualizing Strategy for Client Goals

Information alone isn’t insight. Interpretation is where relevance is personalized—where context, nuance, and lived experience enter the frame.

This is why AI doesn’t replace advisors; it simply augments their work. By layering real-time inputs with behavioral data and personal milestones, AI-powered tools like those of HighPeak help advisors move beyond reactive recalibration to proactive and strategic design.

The Behavioral Intelligence Factor

Change is a given – and clients, being human, can react irrationally to it. But genuine concerns can drive erratic financial choices as well, and as an advisor, you’ll need the data to know when your clients may be susceptible to external pressures like inflation or health concerns. There’s also all of that data that your client may not know about – such as longevity trends.

When longevity trends extend average lifespans by two years in a client’s demographic, that may represent a fundamental recalibration of withdrawal rates. That means your client may need to adjust their strategy.

Advanced AI platforms, like HighPeak AI, can process hundreds of millions of data points to identify these behavioral patterns before they become obvious. That means you can have those essential conversations with clients and base your recommendations on data that they can understand.

With access to data that helps you put your strategies in context, you will be able to answer questions like:

- Is this data point relevant because of its content or because of how it interacts with my client’s context?

- Would this interpretation lead to a strategic shift or is it just a temporary adjustment?

- Am I assuming that client preferences haven’t evolved alongside external changes?

If you don’t have access to healthcare and longevity data, the next section will show you how to access it quickly, even if you’re working with a legacy tech stack.

Moving From Insight to Action

AI-driven data tools, like HighPeak AI, can help advisors map insights to specific client goals, providing context and new perspectives on life-changing variables like long-term care costs and healthcare inflation.

Microservices are just what they sound like—miniaturized services delivered via API and designed to work with your predictive analytics suite of choice and unlock new value. HighPeak AI uses microservices to allow you to run complex healthcare and longevity cost simulations and gain valuable insight into potential future expenditures. That means you’ll be able to talk with your clients about the potentially most impactful areas of their financial futures—healthcare and longevity—with a powerful scenario-building tool designed to help them see the big picture.

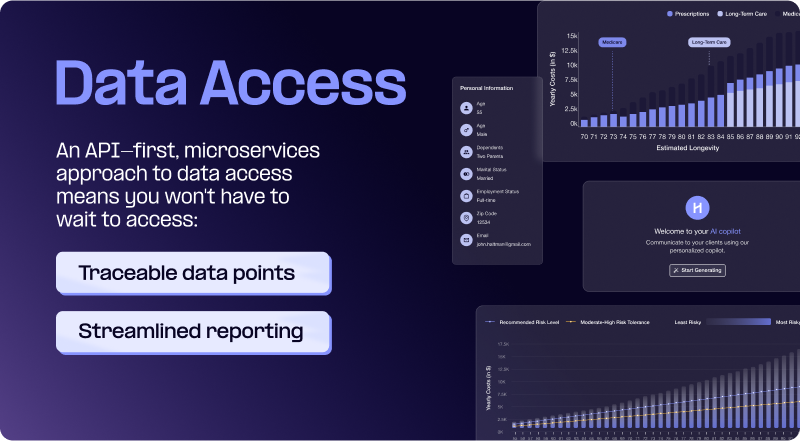

Data Access: The On-Ramp Making Data Work Harder

An API-first, microservices approach to data access means you won’t have to wait to access:

Traceable data points

When you recommend a strategic shift based on emerging healthcare cost trends, the data lineage behind it will be transparent. HighPeak AI tools deliver proprietary, compliant insights.

Streamlined reporting:

HighPeak AI provides a user-friendly dashboard that allows you to easily share data and produce simple, elegant reports for your clients.

For example, longevity insight is paramount for retirees. Your ability to provide clear, relevant, and up-to-date information on longevity trends around each strategy you recommend is critical to your client relationships.

Data is Everything: Structured Insight as a Strategic Differentiator

With the rise of AI and the democratization of big data, your competitive edge no longer lies in interpretation. How well can you translate the world for your clients?

Healthcare and longevity data can help you:

- Detect what’s significant

- Decode what it means

- Map where it fits

- Execute when it matters

When your practice is powered by real-world data—like healthcare inflation trends and longevity data—you can build strategies that can help your clients anticipate and adapt to change.

Ask yourself:

- Does your data platform surface significance or just trend volume?

- Can you trace the evidence behind every recommendation?

- Are your data tools connectable, operational, and resilient?

Start Now: Less Guessing, More Guiding

In a world overloaded with information, clarity is your value proposition. The question isn’t whether you have enough data, it’s whether your data is working hard enough for your clients.

Ready for access? Discover how HighPeak AI microservices can unlock new insights for your predictive analytics platform.